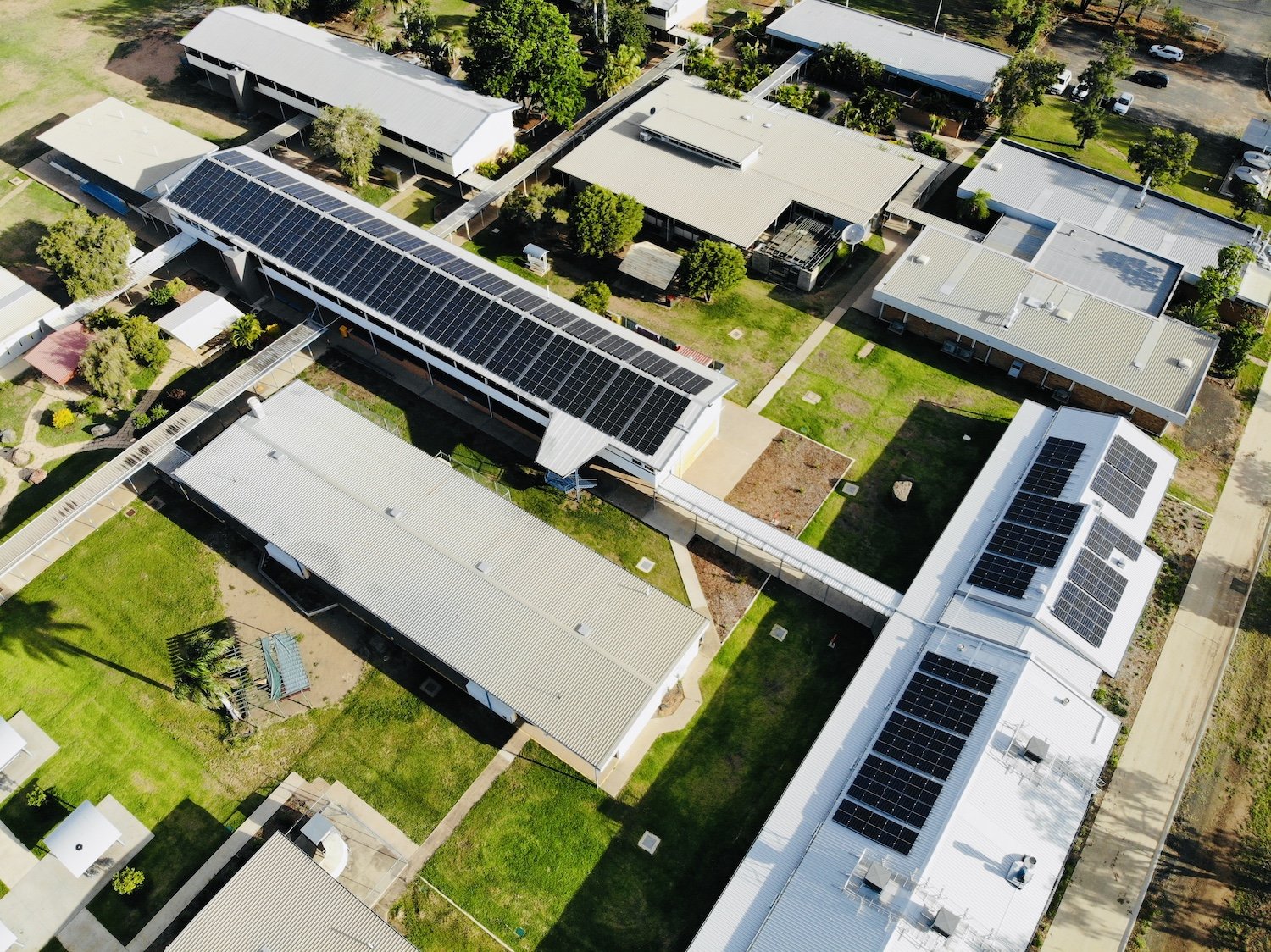

Solar Set is one of Australia’s leading commercial solar installers, having delivered over 45MW of clean, reliable and renewable energy, straight from the sun.

Our commitment to delivering the highest quality solar and battery systems, our technical expertise and exceptional end to end project management is what sets us apart.

From airports, schools, logistics centres and local businesses, we’re empowering businesses with reliable, cost effective and environmentally friendly solar energy solutions.

Our Services

Servicing businesses across Queensland, NSW, Victoria and South Australia, Solar Set specialises in portfolio wide commercial solar solutions.

Changing your business is possible. We’ve done it before.

We understand the drivers behind a successful investment in solar energy and have the credentials and proven track record of delivery.

With extensive experience across large scale government and council solar projects and complex commercial solar sites, the team at Solar Set is well positioned to deliver your renewable future.

Commercial solar solutions.

We're focused on maximising the performance of your solar site to deliver long term savings and sustainable consumption solutions.

Scaling large regions across QLD, NSW, Victoria and South Australia, our team specialises in portfolio wide commercial solar installations, providing a seamless delivery and consistent level of service.